Are you new to Gunbot and feeling overwhelmed by all the options out there? I know I was when I first started out. That’s why I’m excited to share a simple yet effective strategy preset with you today.

It’s based on the stepgridscalp strategy, and it’s available in Gunbot v25. With this preset, you’ll only need to worry about a handful of settings that are most relevant to your daily use.

So, what can you expect from this preset? It’s a grid-like approach that trades frequently without too many restrictions. All you need to adjust is a maximum of five settings, and you’ll be good to go.

This is exactly how this preset trades. Chart in 5m resolution.

If this sounds like the kind of strategy you’re interested in, give it a try! And if you’re looking for something different, don’t worry — there will be more presets coming in the future. Stay tuned!

Ready to dive into the preset and see what it can do for your trading? Great!

Download the preset

First, you’ll need to download the custom editor template here: https://www.gunbot.com/presets/sgs_preset1/

Once you’ve downloaded the file, place it in the same folder as your config.js file and restart Gunbot to start using the new template.

The preset will show up as strategy on the trading settings page, with the name sgs_5/15/60_grid+supports+sl

This is how the preset looks like in Gunbot trading settings. Note that there are just a handful of options, where normally there are 60+ settings just to configure stepgridscalp.

sgs_5/15/60_grid+supports+sl

Let’s break down what that actually means.

First, sgs stands for stepgridscalp, which is the latest iteration of the Gunbot stepgrid strategy series.

5/15/60 represents the timeframes this strategy uses. It trades on 5m charts and uses 15m and 1h chart data to reduce risk and slow down buying when those upper timeframes point downwards.

Grid refers to the fact that this strategy mostly trades in grid mode, placing buy and sell targets around each last order price.

Supports refers to the strategy’s ability to stop trading in grid mode during downtrends on higher timeframes and instead aim for trading at support levels until the market improves.

Sl stands for stop loss, in this case it’s only used to take small losses on assets bought near the top of a low timeframe trading range. This is to reduce the negative effect such high buy orders have on future DCA performance. It will only stop loss positions up to 3x the size of a single grid buy.

Now that you’ve got editor template installed, it’s time to configure it to fit your needs.

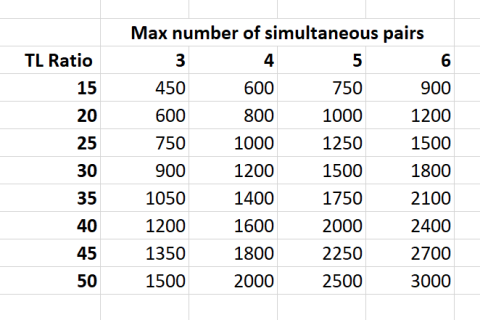

First, go to the Trading Settings page and select the new strategy. Then, adjust your investment limits to fit your preferences.

Keep in mind that this is a fairly aggressive strategy, so you may want to start with a lower base order size to get a feel for how it performs before allocating more funds.

With the default max buy count of 40, you can expect the strategy to work for quite a while — but be aware that it will probably not be enough in case the market goes down for months on end. Keep reserves, select assets you don’t mind holding.

Next, head over to the Gunbot setup page and disable the option to cancel open orders. This is needed because this particular strategy has it’s own logic for cancelling orders.

Keeping track of what the bot is doing

To keep track of how the strategy is performing, check out the status information displayed on the right sidebar of the chart page.

When you know how to read it, the information in the sidebar tells you exactly what is going to happen next.

Allow new trades: This will show “yes” if the bot is ready to open a new trade, and “no” if it is not. For example, it might show “no” if the market is very bearish on higher timeframes.

Allow buy step: This will show “yes” if the bot is ready to place a DCA order, and “no” if it is not. For example, it might show “no” if the market is overbought and your exhaustion sensitivity does not allow for buying into overbought markets.

Status: This will show one of three things: “grid,” “scalping,” or “supports.”

If it’s in “grid” mode, expect the strategy to trade any time it hits a step up or down.

If it’s in “scalping” mode, the bot will be a bit more cautious and will wait for a price dip before opening a new position.

If it’s in “supports” mode, the bot will place limit buy orders on medium or long term support levels and will not do grid buys until the market improves. Open orders will be cleaned up any time a regular grid buy happens again, or when a full position is sold.

This is how it looks in status supports, the bot patiently waits for buy orders at supports to fill.

What to expect from this preset

So, what can you expect from this preset for the stepgridscalp strategy? First and foremost, it’s a bot that’s designed to take small profits frequently. Keep in mind that “small” is relative and will depend on current market volatility.

It’s intentionally slow in downtrending markets, to wait for the market to improve and save capital for when it can be used in a better way, and slow in sideways markets to prevent too many consecutive buys in the same price area. In uptrending markets, the strategy really shines and becomes very active.

Overall, you can expect a bot that’s designed to be agile and adaptable to changing market conditions. Happy trading!

It’s really good at taking advantage of bigger moves, using dynamic trailing ranges.

About the tools

Gunbot is a versatile trading bot for most popular crypto exchanges. It runs on your own computer or server (win, lin, mac) and has a life time license model. This is not a subscription service, there are no recurring costs. For this setup to work you need Gunbot Standard or higher.

Gunbot – Crypto Trading Bot. Start free trial | gunbot.com

Example charts

Below a few screenshots of trading behavior of this strategy preset. Note how it generally is inactive during downtrend.

Did you like this article? Please give a few claps, or a lot 🙂

Gunbot strategy presets in 2023 part 1: fast and balanced grid trading was originally published in Gunbot on Medium, where people are continuing the conversation by highlighting and responding to this story.

Gunbot – Medium